Agronomy Update

Nov 04, 2024

Yellow Pea and Chickpea Variety Update

Private companies and public breeding programs have made significant investments in recent years to produce new pulse varieties and these efforts are now paying off with recent releases. Progress has been made in the root rot resistance of some pea varieties out of Agriculture and Agri-Food Canada. Below is a summary of some of these newer varieties and where you can find more information about them.If you have been struggling with root rot on your operation consider planting AAC Julius on the under-performing acres next time you plant that field to peas. While it isn’t completely resistant, NDSU trials have repeatedly shown that this variety will outyield older varieties under root rot pressure. AAC Julius is sold through North Dakota Crop Improvement. This variety is also resistant to powdery mildew, which can become an issue in hot dry years, and is a consistent high yielder. Overall, progress has made in the Canadian yellow pea varieties with 5-10% yield improvements over the check variety CDC Amarillo with recent releases.

Croplan has released some new yellow pea varieties: CP5222Y and CP5244Y. In 2023 Montana State Variety Trials yield was fairly consistent with AAC Julius, ND Dawn and DS Admiral with good protein. More information can be found on page 146 of their 2025 seed guide.

ND Crown is a recently released NDSU chickpea variety with similar levels of Ascochyta resistance to CDC Frontier, Orion and Leader and comparable yields. Seed size is larger than CDC Frontier and similar to CDC Orion. This variety performed well in Williams County grower fields in 2024 and approximately 6,000 bushels of seed are available for 2025 from the NDSU Williston REC Foundation Seedstocks program.

Dr. Audrey Kalil

Agronomist/Outreach Coordinator

Winter Fertilizer Buying

We are just barely starting to surface apply urea now that the soil temperatures are staying in the low 40’s and Halloween was the first day temperatures were dipping down to the high 30’s. I have seen growers either surface apply urea themselves, or have dealers apply it, in September and October without realizing the fate of their nitrogen. Even if you are enticed by cheap urea and can save $100 per ton on urea by having it done early like this, it will more than likely cost you in the end.Research trials have shown losses at this time of year with surface applied urea, of anywhere from 10% up to 75%, but I think 25% losses are more realistic. This is mainly due to volatilization of urea releasing nitrogen to the atmosphere. Feel free to stop into my office and we can go through the math on this, but with a 25% loss of nitrogen due to volatization, you can turn $400 urea into $533, and even worse, you could cut your production by amounts that would actually pay for all of your nitrogen in the first place! If you see a hint of yellow in wheat fields that had fertilizer spread the fall before, you might be seeing the result of spreading at the wrong time. Even if you think you are getting a bargain and are saving $100 per ton, it will cost you in the end if you do not apply it at the correct time. A difference in $100 per ton for urea will also not affect your farming operation as much as you think. The cost of production is only affected by $.25 per bushel with a 40-bushel yield when you are using 200 lbs. per acre. No matter what side of that price you are on, nitrogen is still the best investment you can make in your farming operation.

Historically, the best time to buy fertilizer for the crop year is the fall or winter before planting season. I have only seen maybe twice in the past 20 years that nitrogen prices dropped after January and before the spring application season. I don’t think this year will be the year that we see prices drop at all between now and spring. Even with low commodity prices, we are getting too late in the season already for a drop in prices that would be significant at all. A lot of dealers have sat waiting for prices to drop all fall long, since the lowest price since the spring season was probably the end of May instead of June or July and I don’t think there were many unit trains being sold in the country. Our prices are actually lower than international prices which have Arab Gulf, African, Chinese and Russian tons out of North America for the most part. With US retailers and farmers not doing a lot of buying, we have become a net exporter of nitrogen this summer and fall. There have been significant US tons sold into South America paying more profits to the US fertilizer producers. As we enter our winter prepay season with nitrogen fertilizer, once the US retailers and farmers do decide it is time to buy, it will become the supply and demand scenario, and I would anticipate the prices will bump up. I don’t see much of a chance that prices will soften after the first of the year when we are so close to application season especially in the Southern plains.

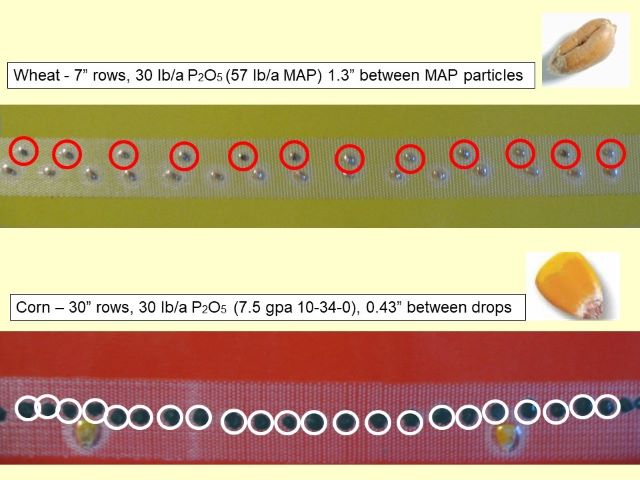

What about phosphate fertilizer after the hurricanes in Florida? There were actually allocations in place with some of the Florida producers before the first hurricane, and over 500,000 tons of production were affected by the two hurricanes, so that will kind of give you a glimpse of how this market will play out. Those that have tons will be able to sell tons, and those that don’t might have to go to plan C or plan D, wherever they are now. We have a really good relationship with the largest producer in Florida so we had an allocation of a 90-car unit train of phosphate well before the first hurricane and we will actually be unloading these cars this week, so yes, we have tons. For those people who are being approached by the “slick salesmen” trying to sell you high efficiency phosphate fertilizer, I will throw out this warning, there is no such thing as high efficiency fertilizer. They are about twice the price as a regular phosphate fertilizer, but they try to sell you by only using half as much fertilizer. The thing about phosphate fertilizer is that it is very immobile in the soil and will only move a distance of about the size of a quarter. We try to keep our rates with our seed at about 60 lbs. per acre partly because of this fact, keeping the fertilizer granules within range of the seedling. If you cut your rate to 30 lbs. per acre, then only about half of your plants in the entire field will get the starter effect out of your seed placed fertilizer. Agvise Labs, an independent third party that does not sell fertilizer, did a study demonstrating this. A picture from their work is below.

I also have an email reply from one of the most respected University soil specialists with over 45 years of experience, giving his opinion on high efficiency fertilizers including both liquid nitrogen and high efficiency phosphates. If magical products actually worked, don’t you think everyone would be selling them? Nope, just a select few by quote “slick salesmen”.

Phosphate fertilizers may become tight with what has already happened, so you might want to come into your local Horizon Resources Agronomy location and buy or book your spring tons so you will have them available. We will have December prices and will also have spring prices if you just want to book your tons. Our winter fill urea tons will only be about 40% of what we need for spring and as I already stated, prices will normally go up between the end of the year and the spring application season, so buy or book your tons now to give yourself the peace of mind that your tons will be here in our plants when you need them in the spring.

John Salvevold

Agronomy Division Manager, CCA

Canola Insecticide Seed Treatment

Flea beetles are the most important pest of canola and insecticide seed treatment is our first line of defense against feeding damage on young seedlings. There are two species of flea beetle in North Dakota, Cruicifer flea beetle and Striped flea beetle. While Crucifer flea beetle is more abundant, we are concerned about the Striped flea beetle because it has shown tolerance to neonic seed treatments, making those seed treatment products less effective.There are several options for canola insecticide seed treatments which are indicated in the table below, with three modes of action.

| Trade Name | Active Ingredient | Insecticide Class (IRAC) |

| Helix Vibrance (HV) | Thiamethoxam | Neonicotinoid (4A) |

| Prosper Evergol (PE) | Clothianidin | Neonicotinoid (4A) |

| Lumiderm (L) | Cyantraniliprole | Diamide (28) |

| Fortenza (Fort) | Cyantraniliprole | Diamide (28) |

| Buteo Start (B) | Flupyradifurone | Butenolide (4D) |

Helix Vibrance is the standard “base package” of insecticide seed treatment, and there are options to add either a diamide (Lumiderm or Fortenza) or butenolide (Buteo Start) at additional cost. If flea beetle populations are becoming tolerant to the neonic (4A) insecticide class then there should be an advantage to using a second ingredient for both efficacy of control and improved yield. To determine whether this is in fact the case, Dr. Anitha Chirumamilla, Extension Specialist from the NDSU Langdon REC, and her colleagues at the North Central REC in Minot and the NDSU Agronomy seed farm in Fargo conducted trials in 2023 comparing these different seed treatment options with and without a foliar insecticide. The study is published in the 2023 LREC Annual Report and the results I share below are the pooled across the three locations.

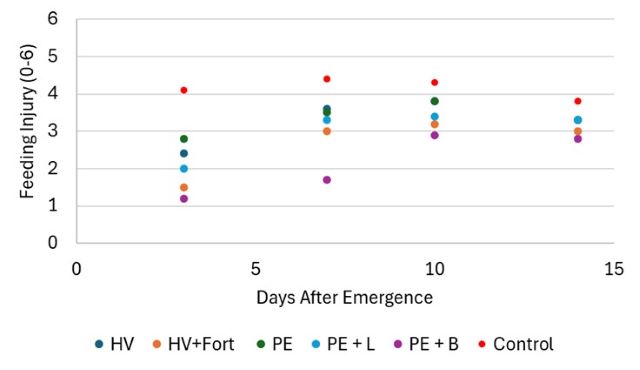

In the NDSU studies, flea beetle damage was rated on a scale of 0 to 6 where 0 is no damage and a 6 is a completely dead plant. The control treatment did not receive an insecticide. In the chart below the dots in red indicate the control treatment where feeding damage is high beginning 3 days after emergence (DAE). At this point, all of the insecticide seed treatments are reducing feeding damage compared to the control. At 7, 10 and 14 days after emergence the treatment with a neonic plus Buteo (PE + B) starts to pull away with the lowest damage (purple dots).

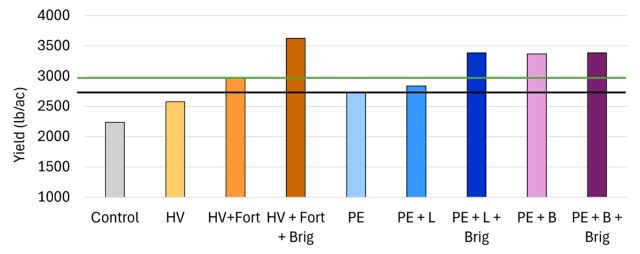

This difference in feeding damage was reflected in the yield (chart below). All insecticide seed treatment improved yield over the untreated control (gray bar). Adding the Lumiderm or Fortenza (diamide) to the base neonic seed treatment of Helix Vibrance of Prosper Evergol boosted yield slightly but the difference was not statistically significant. The treatments above the green line are the highest yielding treatments. This included all of the treatments that received both the seed treatment and a foliar insecticide application of Brigade 2EC which has the active ingredient bifenthrin (+Brig) along with the PE+B seed treatment alone (light purple bar).

Adding Buteo Start to the Prosper Evergol significantly improved flea beetle control and yield. This was also the only seed treatment which did not require a foliar insecticide application to maximize yield. While the addition of the Fortenza and Lumiderm to the Helix Vibrance or Prosper Evergol respectively did not improve yield when data was combined across all locations, it did improve yield at the Langdon location. It is possible that neonic resistance is more common in that part of the state given the history of canola production and that might explain this result. Alternatively, this also may be due to the higher yield potential in that area.

Pesticide resistance is not a new problem, and in fact, this seems to be our “new normal.” By using at least two modes of action we slow the spread of insecticide resistance, which is important given the lack of new modes of action entering the market place. With the Buteo Start, it might also give us some flexibility in the use of a foliar insecticide.

Dr. Audrey Kalil

Agronomist/Outreach Coordinator

2024 Corn and Soybean Season Summary

If we had to use one word to sum up the end of the 2024 cropping season it would be DRY. The upside to this is that there is very little if any corn or soy- bean that needs to be harvested in November. The downside is that it was VERY DRY with soybeans harvested at single digit moisture percentages and much of the corn was field dry and didn’t require much if any drying. But why would that be a downside, you may ask? Well, let’s discuss that…Soybeans

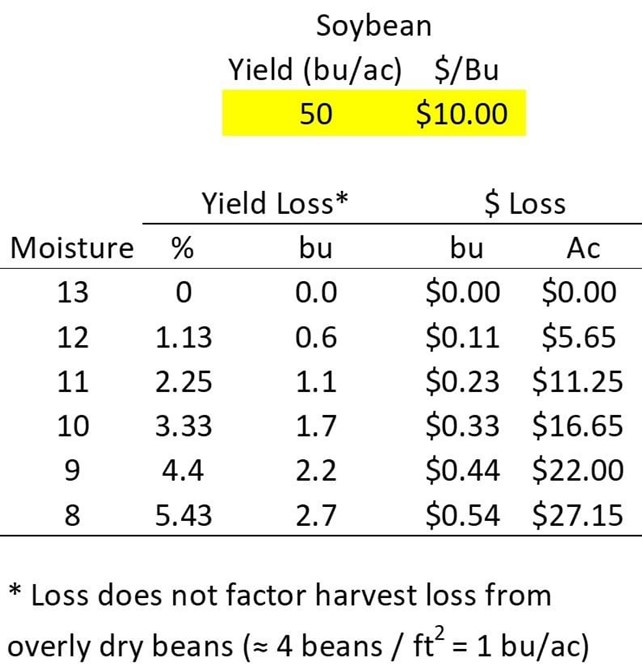

Soybeans are dry enough for storing when moisture content floats around the 13% to 13.5% mark and typically elevators will not take anything wetter than this. Every farm I work with harvested soybeans at 8-9% moisture this year and two things can happen when soybeans get this dry. For starters, soybeans at single digit moisture are very brittle, and pods popping open and shelling on the ground become a real risk, especially after strong wind events (see picture below).

When counting seeds that pop out of shells and on the ground, every 4 seeds per square foot equates to 1 bu./acre. Secondly, a loss is incurred with the amount of shrinking that happens. Soybean drying down to 8% can see harvest losses of over 2.5 bu./acre (Table above). With both harvest loss and shrinkage, it’s realistic to say that 4-7 bushels per acre were lost with the extreme dry harvest conditions this year.

So, the real question is, how do I mitigate this type of loss at harvest again? My eyes roll when I hear any person say “just wait for rain so the beans gain moisture again,” because we know how that works relying on mother nature. Here are two simple things to consider. One, if you don’t already own one, get an air bar kit for your header. Secondly, make sure you are growing 2-3 different maturities of soybeans to spread out when the beans begin to ripen and dry down.

Corn

Many corn fields looked like the one pictured below or worse this year. Lots of down corn has made harvest go painstakingly slow and some substantial harvest loss has occurred. I’ll break down what has happened in corn into two categories to discuss the differences.

Ear Drop

Ear drop is not as uncommon as one may think. A dry August that drags into the fall can easily create the right environment for this to happen. In that dry environment, lack of nitrogen and drought can lead to the ear shank on certain corn hybrids becoming weak and with minimal force they will break off and fall to the ground. Generally, the hybrids that exhibit this are those that have high yields under better conditions, so don’t necessarily write off a hybrid that drops ears. A better approach is to possibly put that hybrid on less acres and in fields that you know won’t be exposed to late season nitrogen stress (heavier ground vs sand).

Stalk Lodging

I see stalk lodging far less than ear drop in our area. The conditions I saw that were the worst for it this year was northeast of me in the Washburn/ Underwood area. Heavy rain events in June with no trace of rain after July

4th with some extremely hot days set the stage. Stalk lodging is the result of a genetics by environment interaction like ear drop but there is some influence from disease as well. The excessive moisture early on during and after planting set up some conditions for stalk rot in corn (Fusarium mostly, but some Anthracnose as well). The wet start that created the environment for a stalk rot pathogen to establish was followed by extreme hot and dry, and this set up conditions that will eat away the stalk of any normal corn hybrid making it weak and prone to lodging. You couple that with some of these hybrids that are known to die and dry down fast and you have a perfect storm for one wind event to come in and blow things flat to the ground.

So, in the circumstance of stalk lodging at harvest, would I advise you to do anything differently with corn hybrids or fungicides? My answer is likely not. This is something that is going to potentially happen again but it’s not something in my opinion that can necessarily be prevented. BUT, you can check fields in September for stalk integrity by giving the plant a firm push just above the ear and seeing if it breaks over or bounces back. If it bounces back, it’s likely going to holp up well all harvest. In the event that you have plants that stay kinked or broken after giving them the push test, these are the fields you need to be paying extra attention to and making plans to harvest early or at least first out of your corn acres.

Kyle Okke

Crop Consultant, CCA